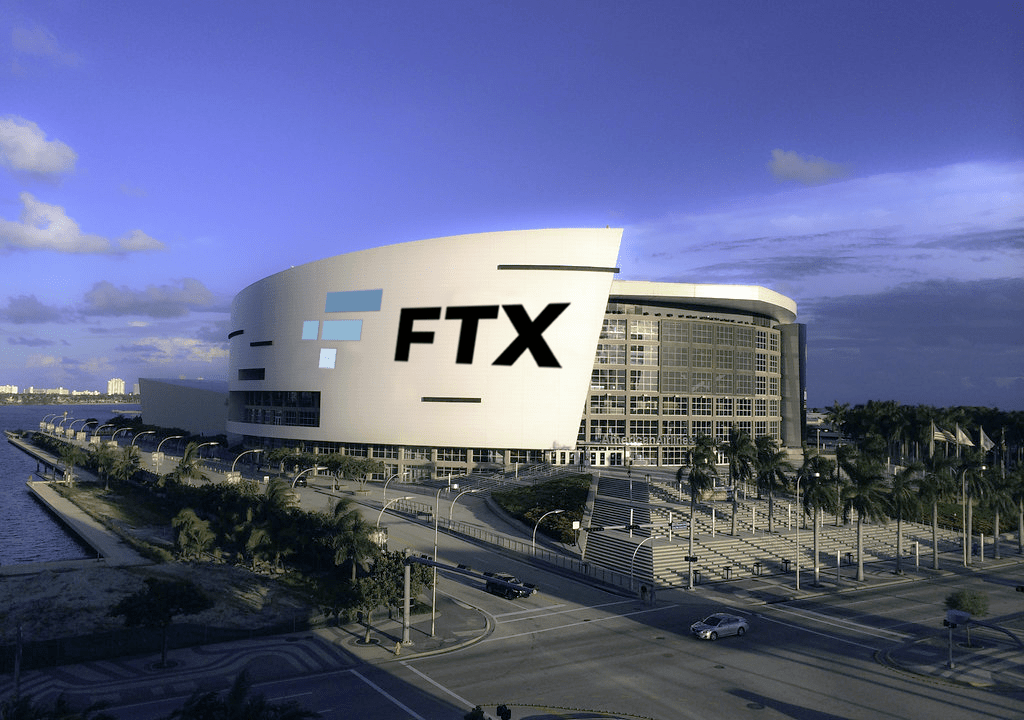

On November 8, 2022, the cryptocurrency world was rocked by the shocking news surrounding FTX, a major cryptocurrency exchange founded by Sam Bankman-Fried. This day marked a significant turning point not only for FTX but for the entire digital currency ecosystem. The unfolding events on this day would lead to questions, investigations, and a reevaluation of trust within the cryptocurrency market. In this article, we will explore the details of what happened on that fateful day, the impact on investors and the broader crypto community, and the implications of the FTX crisis for the future of digital currencies.

As the news broke about FTX's financial troubles, investors and traders scrambled to understand the situation. What began as a lack of liquidity quickly escalated into a full-blown crisis as reports emerged about potential insolvency. Sam Bankman-Fried, once heralded as a savior of the cryptocurrency space, found himself at the center of a storm that would lead to the collapse of his empire. This article will provide a comprehensive overview of the events that transpired, including a timeline of key actions taken by FTX's leadership, regulatory responses, and the overall fallout experienced by the cryptocurrency sector.

Join us as we delve into the details surrounding Sam Bankman-Fried's FTX offices on November 8, 2022. We'll examine the factors that contributed to the exchange's downfall, the reactions from stakeholders, and the lessons learned from this unprecedented situation. Whether you are an investor, enthusiast, or simply curious about the world of crypto, this article will provide valuable insights into one of the most significant events in the history of digital currency.

Table of Contents

- Background of FTX and Sam Bankman-Fried

- Key Events on November 8, 2022

- Impact on Investors and the Crypto Market

- Regulatory and Market Responses

- Lessons Learned from the FTX Crisis

- Future of FTX and the Cryptocurrency Landscape

- Conclusion

- About Sam Bankman-Fried

Background of FTX and Sam Bankman-Fried

FTX was founded in 2019 by Sam Bankman-Fried, who quickly became a prominent figure in the cryptocurrency industry. With a mission to provide a reliable and user-friendly trading platform, FTX gained significant traction, attracting millions of users and billions of dollars in trading volume. The company was known for its innovative products, including derivatives and tokenized stocks, and earned a reputation for its philanthropic efforts.

Under Bankman-Fried's leadership, FTX received substantial investments and partnerships, further solidifying its position in the market. However, behind the scenes, concerns about financial practices and risk management began to surface, setting the stage for the chaos that would erupt on November 8.

Key Events on November 8, 2022

The events of November 8 unfolded rapidly, beginning with reports of liquidity issues at FTX. Here’s a timeline of the critical moments:

- Early Morning: Reports surfaced indicating that FTX was facing a liquidity crisis, leading to widespread concern among investors.

- Mid-Morning: Binance, a major competitor, announced it would acquire FTX, sparking hope among users.

- Afternoon: Binance backed out of the acquisition after conducting due diligence and discovering the extent of FTX's financial troubles.

- Evening: FTX suspended withdrawals, leaving users unable to access their funds, exacerbating the panic.

Immediate Reactions

As news broke, social media platforms were flooded with reactions from investors, analysts, and industry insiders. Many expressed disbelief over the rapid decline of one of the industry's leading exchanges. The situation escalated as users rushed to withdraw funds, leading to a further liquidity crunch.

Impact on Investors and the Crypto Market

The fallout from FTX's crisis was immediate and severe. Thousands of investors found themselves unable to access their funds, leading to significant financial losses. The broader cryptocurrency market also felt the impact, with major cryptocurrencies experiencing sharp declines in value.

Key impacts included:

- Loss of Trust: The incident shattered trust in centralized exchanges, prompting many users to consider self-custody options.

- Market Volatility: The market saw substantial volatility, with Bitcoin and Ethereum prices dropping significantly.

- Increased Scrutiny: Regulatory bodies began investigating FTX and the broader cryptocurrency market, signaling a potential shift in regulatory frameworks.

Regulatory and Market Responses

In the wake of the FTX crisis, regulatory bodies worldwide began to take a closer look at cryptocurrency exchanges and their practices. Here are some key responses:

- United States: The SEC and CFTC launched investigations into FTX's operations and compliance with securities laws.

- Global: Other countries began to issue warnings to investors and scrutinize their own regulatory frameworks concerning cryptocurrency.

- Market Reactions: Major exchanges implemented stricter withdrawal limits and transparency measures to restore user confidence.

Lessons Learned from the FTX Crisis

The FTX crisis served as a wake-up call for the cryptocurrency industry, highlighting several critical lessons:

- Importance of Transparency: Exchanges must prioritize transparency in their operations and financial health.

- Risk Management: Effective risk management practices are essential to safeguard user funds and maintain trust.

- Regulatory Compliance: Adhering to regulatory standards is crucial for long-term sustainability in the cryptocurrency market.

Future of FTX and the Cryptocurrency Landscape

As the dust settled from the FTX crisis, the future remained uncertain for both the exchange and the wider cryptocurrency landscape. The incident prompted calls for stronger regulations and oversight, potentially reshaping the industry. Investors began to seek alternatives, focusing on decentralized finance (DeFi) platforms and self-custody wallets.

The long-term impact of the FTX crisis will likely lead to a more cautious approach from investors and a demand for increased safeguards in the cryptocurrency space.

Conclusion

In conclusion, the events surrounding Sam Bankman-Fried's FTX offices on November 8, 2022, marked a significant turning point for the cryptocurrency industry. The crisis revealed vulnerabilities within centralized exchanges and underscored the importance of transparency, risk management, and regulatory compliance. As the market moves forward, it is essential for investors and industry stakeholders to learn from this experience to build a more resilient and trustworthy cryptocurrency ecosystem.

If you found this article informative, please leave a comment below, share your thoughts, or explore more articles on our website to stay updated on the latest developments in the cryptocurrency world.

About Sam Bankman-Fried

| Attribute | Details |

|---|---|

| Name | Sam Bankman-Fried |

| Date of Birth | March 6, 1992 |

| Education | Massachusetts Institute of Technology (MIT) |

| Occupation | Entrepreneur, Investor |

| Known For | Founder of FTX |